In Australia, there is no upper limit on the amount you can claim as a tax deduction for charitable donations — as long as certain conditions are met.

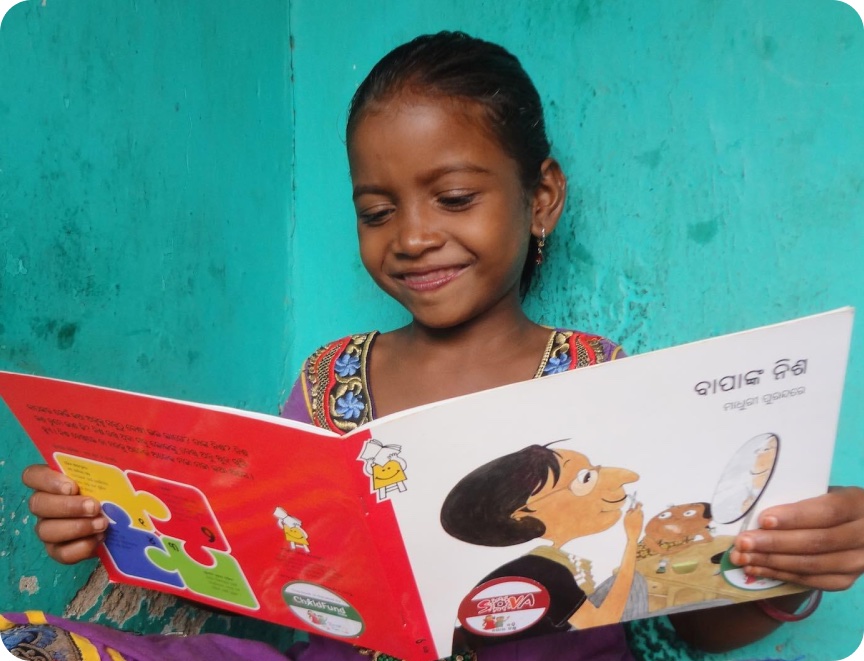

Your donation must be made to a Deductible Gift Recipient (DGR) — a registered charity or organisation approved by the ATO like ChildFund Australia.

– You can claim donations of $2 or more.

– The donation must be a true gift, meaning you don’t receive a material benefit in return (e.g. a raffle ticket or dinner).

– You’ll need a receipt from the charity that includes their ABN and confirms it’s a DGR.

– Donations are claimed in your individual tax return in the year they were made.

While there’s no set cap, the donation deduction cannot create or increase a tax loss. If your deduction is larger than your taxable income, the excess can be carried forward to future tax years.